Lufthansa today announced that Miami would be the next US destination to be served by Airbus A380. The world’s largest passenger airplane would replace the Boeing 747 currently operated on the Frankfurt – Miami route.

Lufthansa A380 - Courtesy: Lufthansa

Lufthansa’s selection of North American destinations for A380 is interesting:

New York JFK is currently served four times a week using A380. The JFK service will become a daily on A380 starting April 10, 2011 (this means LH will delay the resumption of A380 service to Tokyo Narita, suspended due to the recent Tsunami and Earthquake, for a longer period). San Francisco will be served using A380 starting May 10, 2011. Miami will get A380 service starting June 10, 2011.

The JFK service is a no-brainer. The interesting thing to note here is Lufthansa’s preference of Miami and San Francisco over Newark Liberty (EWR), Chicago O’Hare (ORD) and Washington Dulles (IAD), all Star Alliance hubs and major gateways for LH. As more A380’s join the fleet, these gateways would get the service, but right now, they are not included.

There could be several reasons for this. I believe the following reasons played a major role in the selection process.

1. Single daily flight is easy to upgrade: Miami, with just one flight per day, and virtually no connection traffic, gives Lufthansa the flexibility to switch the metal from B747 to A380. San Francisco, though a Star hub, is also served by a single Lufthansa flight. So, it is easy for LH to replace the B747 with A380. Newark, Chicago and Washington need multiple flights from Frankfurt, as Lufthansa connects majority of its US bound traffic from these hubs through Star partner United. From these hubs, Lufthansa needs multiple frequencies a day to provide better connection options to its frequent flyers.

The exceptions to this theory are Toronto (YYZ) and Los Angeles (LAX), both Star hubs with a single Lufthansa flight (though Toronto is served by 2 daily flights from its anchor Air Canada).

2. A380 better than B744 on non-hub cities: Operating an A380 is more cost effective than a B744. Lufthansa’s B744s have poor customer reception. Replacing them with A380 would provide a better chance to protect its turf in hubs dominated by other carriers (MIA is a good case – it could deter American Airlines from starting a competing service).

3. Alliance Partners have a say in equipment upgrade: United and Air Canada have a transatlantic joint venture with Lufthansa and the schedules at Star hubs are coordinated between these carriers for optimal connections. United, being the anchor at EWR, ORD and IAD, has to make sure parity of service quality with Lufthansa in these hubs. So, United may be less receptive to LH upgrading these routes with A380, because its own product would fall behind in quality. The same argument goes for YYZ and Air Canada.

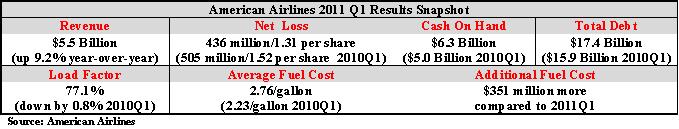

[TABLE=7]

So, my prediction is this: the next Lufthansa destination for A380 will be Los Angeles, followed by Houston and Boston.

Newark, Chicago, Washington and Toronto will have to wait get their turns.

Moral of this analysis: sometimes, being a hub with multiple daily flights to a destination can be a drawback to get better service!!!!