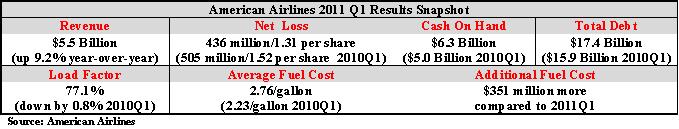

American Airlines today announced its Q1 results. As expected, the carrier lost money. Last year American outlined turnaround plan that would focus on its five cornerstone markets (New York, Chicago, Los Angeles, Dallas and Miami), implementing joint venture agreements on Trans-Atlantic and Trans-Pacific routes. The results reflect the fact that American’s efforts for a turnaround are hampered by the rising cost of fuel. As the only legacy carrier that did not declare bankruptcy, American continued to be hurt by its huge debt, higher labor costs and pension obligations.

Q1 highlights

- Unit Revenue (PRASM) up by 5.2%

- Passenger yield up by 6.2% (year-over-year)

- Unit costs down by 1.8% (excluding fuel costs and special items)

- Mainline capacity up by 2.7%

- Joint business with British Airways and Iberia implemented on Trans-Atlantic routes

- Joint business with Japan Airlines implemented on Trans-Pacific routes

- Enhanced service at Los Angeles LAX (including new LAX – Shanghai route launch)

- New agreements signed with Expedia (and Hotwire)

- New agreement signed with Priceline

- Law suit filed against Orbitz (and Travelport, LLC)

Guidance

- Planning to reduce the domestic capacity and increase international capacity

- Planning to retire 25 more MD-80s in 2011

- Fuel is the biggest concern

- Cost of fuel expected to be $3.10/gallon for Q2 and $3.07/gallon for 2011

- For Q2, 49% of fuel hedged at average cap of 2.66/gallon and 39% of fuel hedged at average floor of $2.04/gallon

- For entire 2011, 41% of fuel hedged at average cap of 2.63/gallon and 35% of fuel hedged at average floor of $2.02/gallon

- Cost per Available Seat Mile (CASM) is expected to be about flat to 2010, excluding fuel and potential new labor costs

- Other concerns include Labor Contracts, Facilities and Healthcare costs

- Unit Revenue (PRASM) up by 5.2%

- Passenger yield up by 6.2% (year-over-year)

- Unit costs down by 1.8% (excluding fuel costs and special items)

- Mainline capacity up by 2.7%

- Joint business with British Airways and Iberia implemented on Trans-Atlantic routes

- Joint business with Japan Airlines implemented on Trans-Pacific routes

- Enhanced service at Los Angeles LAX (including new LAX – Shanghai route launch)

- New agreements signed with Expedia (and Hotwire)

- New agreement signed with Priceline

- Law suit filed against Orbitz (and Travelport, LLC)