The US Airlines raked in a whopping $3.4 billion in baggage fees for 2010, according to the statistics released by the US Department of Transportation. Compare this to $1.14 billion for 2008; the revenue from baggage fees has grown almost 300%. Delta claimed the top spot with almost a billion dollars in baggage fees. The four major network carriers (Delta, United, American, US Airways) each earned more than half a billion dollars in baggage fees.

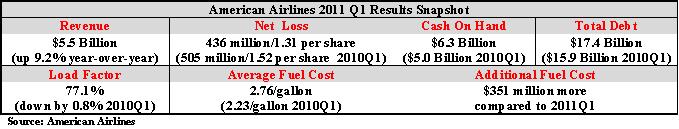

[TABLE=6]

Combine this with $2.3 billion in reservation change/cancel fee – the US passengers paid $5.7 billion in fees. These fees have become a lucrative revenue stream for the airlines in times when the cost of fuel has soared. The industry trade group, Air Transport Association of America (ATA), defends these fees as one way to keep the carriers in black. These fees are here to stay, no matter what happens to the fuel prices.

Some interesting observations:

The big four network carriers account for nearly 80% percent of the baggage fee.

The baggage fees are exempted from the 7.5% excise tax levied on tickets. So most airlines charge baggage fees as a separate line item to take all the profit generated from this ancillary revenue.

Spirit, not a top-15 airline in the US ranks at number eight in baggage fees. As you know Spirit charges for carry-on bags as well (only the carry-on bags stored in overhead bins, not the ones stowed under the seat!). Most airlines do not charge fee for the first carry-on baggage.

Southwest stands out

While all other airlines collect baggage fees, Southwest does not. Southwest needs to be commended for this. Despite being squeezed by the increasing fuel costs, the airline maintains that it has no plans to impose a baggage fee.

More transparent rules are coming

The Department of Transportation in April announced a new set of rules related to the baggage fees. They include:

The airlines must refund the baggage fee (in addition to the compensation) if the baggage is lost or not delivered in a timely manner. As of now, if the baggage is lost or delayed, most airlines do not pay back the baggage fee. Some offer credit for future travel. DOT has not clarified what it would consider a timely manner of delivery. This rule will be effective from August 23, 2011.

Airlines must clearly disclose all the fees in the ticket. This rule will be effective from October 24, 2011. The ATA has asked the government to delay the implementation of these rules for another six months.

Hopefully, with these new rules, the passengers get a fair deal while paying for baggage fees.